Continuing from Part One where we covered the key milestones in the readiness process for an audit, as well as the timelines to consider for assessments in Governance, Risk Management, Compliance, Information Technology and Financial Reporting, we can now take a look at the following competencies within departments and their procedures for audit readiness:

- The required leadership to support assessments

- IT Resources (IT)

- The procedures of internal controls, and

- Information Technology competencies – to be covered in Part 3

Required Support from Leadership

Support from leadership is defined by the organization’s culture to adopt audit readiness, as part of a necessary company process. If leadership supports audit readiness procedures, it will often create an environment that will achieve full cooperation from all levels of the organization and typically will yield better results than an organization without leadership support.

Full adoption and support from leaders across the organization would result in complete engagement planning standards, defining who should be involved in the audit procedure and what their role will be in the readiness process. These leaders should have an ongoing, active role throughout the entire readiness process.

Audit Readiness for IT

To understand the audit readiness procedure for IT, means to have the right employees with the right skills, aptitudes, experience and continuing education in place, who are able to identify any drawbacks or obstacles and correct them along the way. These skilled individuals will also have the capabilities to establish practical solutions to implement, and would have the ability to analyze and address any manual or automated requirements for internal controls. They would also have the ability to determine and/or train supporting staff required to assist in the readiness procedure.

Once IT leadership has successfully put the appropriate readiness resources in place, the resource level of the team, as well as their individual skill needs to be sustained and prepped for growth. Sustainability can be accomplished through continuous training and knowledge sharing within the department. Each resource should also receive challenging tasks or be assigned appropriate projects to challenge and grow the overall IT team skillset, further sustaining the readiness procedure.

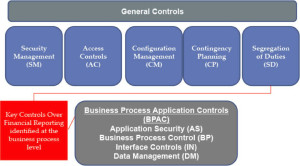

Assurance with Internal Controls

Internal controls requires a designed set of policies and procedures which would need to be implemented and then maintained. Maintaining these policies and procedures provides assurance for the achievement of steady and functioning business operations; compliance for regulated and any legal procedures; and lastly for any reporting.

Once an organization has demonstrated an efficiency with their internal control procedures and has been able to prove that their organization is in good standing, it will prove to be a positive benchmark on the overall health of the organization, including its financial statements.

Please note: These guidelines from Global Shield IS, are for an organization’s general information purposes only. It is not intended to advise or give any legal or business analysis. Global Shield IS, rather offers the services to any business who have further questions related to their uncommon or unique circumstances, to contact the office for further council. We will then assign the most appropriate adviser to address each question specifically.